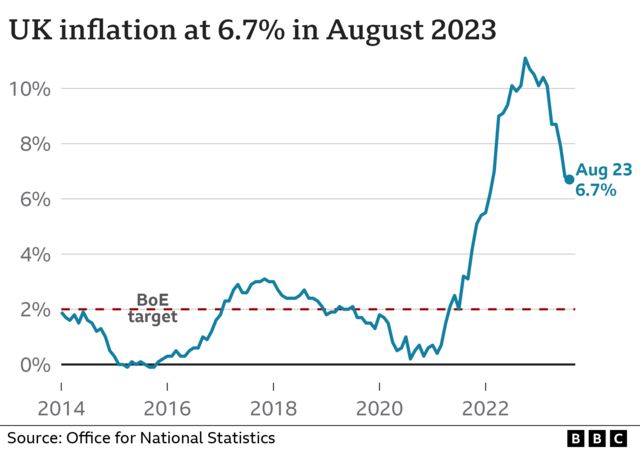

The rate at which prices are rising dropped to 6.7% in the year to August, down from 6.8% in July.

Slowing food inflation on items such as milk, cheese and eggs helped drive the surprise fall, although the pace of food price rises remains high – at 13.6%.

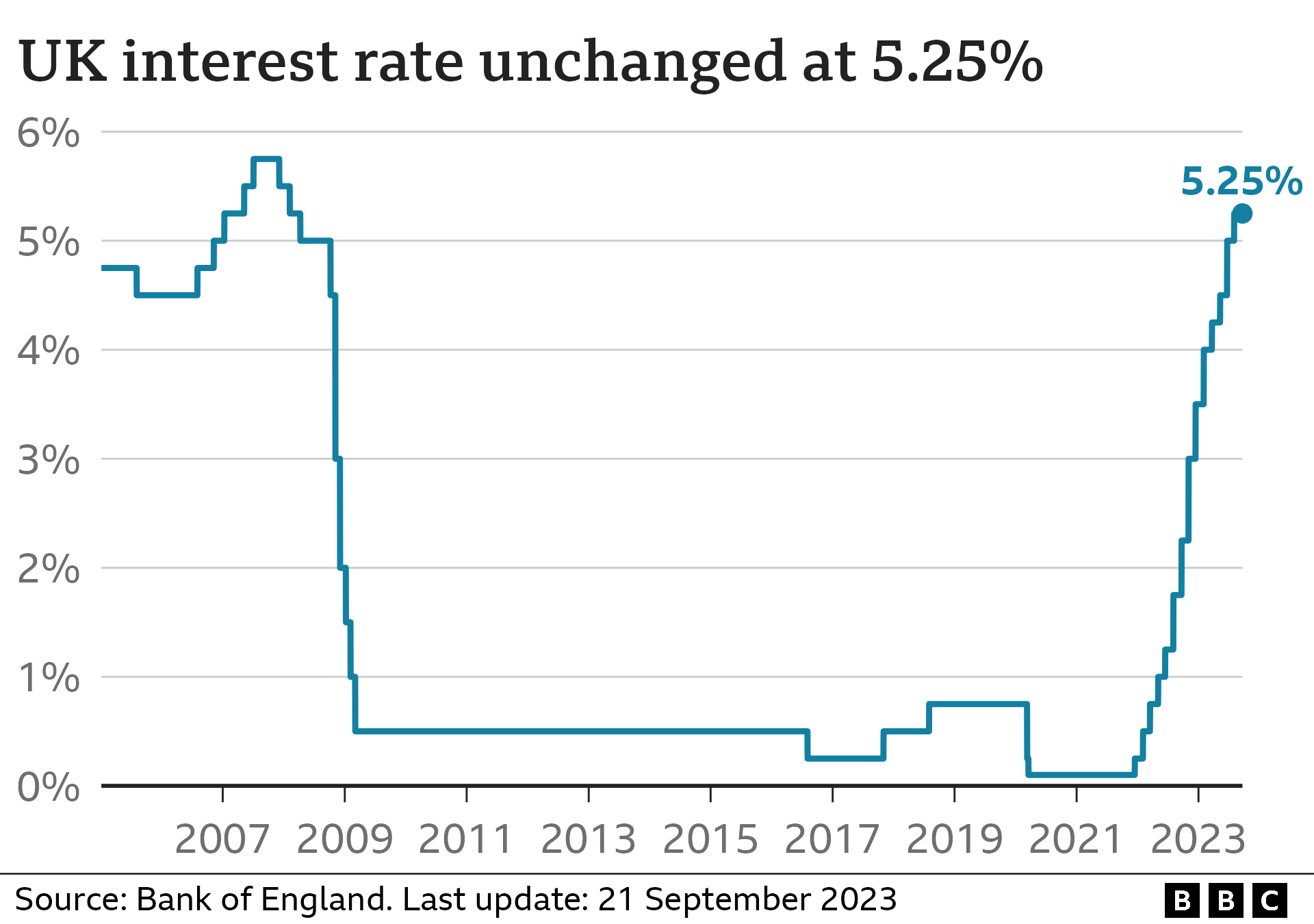

To help slow inflation, the Bank of England has increased interest rates to 5.25%.

What does inflation mean?

Inflation is the increase in the price of something over time

If a bottle of milk costs £1 but £1.05 12 months later, then annual milk inflation is 5%.

How is the UK’s inflation rate measured?

The Office for National Statistics (ONS) tracks the prices of hundreds of everyday items in an imaginary “basket of goods”.

The basket is regularly updated to reflect shopping trends, with recent changes adding frozen berries and removing alcopops.

Each month’s inflation figure shows how much these prices have risen since the same date last year.

You can calculate inflation in various ways, but the main “headline” measure is the Consumer Prices Index (CPI).

The CPI rate was 6.7% in the year to August, down from 6.8% in July, largely as a result of slowing food prices.

In October, Tesco boss Ken Murphy said he expected the pace of rising food prices to keep dropping as wholesale costs come down.

What is “core inflation”?

“Core inflation” excludes the price of energy, food, alcohol and tobacco.

This measure was 6.2% in August, down from 6.9% in June and July, which was the highest level since 1992.

The Bank of England considers this number, as well as CPI, when deciding whether to change interest rates.

Why have prices risen so fast?

Soaring food and energy bills helped drive inflation up.

Oil and gas were in greater demand after Covid. The war in Ukraine meant less was available from Russia, putting further pressure on prices.

The conflict also reduced the amount of grain available, pushing up global food prices.

This effect was compounded in the UK in February by a shortage of vegetables, which took food inflation to a 45-year high.

Alcohol prices in restaurants and pubs also rose.

How does raising interest rates help to tackle inflation?

The Bank of England has a target to keep inflation at 2%, but the current rate remains well above that.

The traditional response to rising inflation is to put up interest rates.

This makes borrowing more expensive, and means some people with mortgages see their monthly payments go up. Some saving rates also increase.

When people have less money to spend, they buy fewer things, reducing the demand for goods and slowing price rises.

Businesses also borrow less, making them less likely to create jobs; some may cut staff.

In August, the Bank increased interest rates for the 14th time in a row, taking the main rate to 5.25%.

It had been widely expected to raise rates again in September but instead held them at 5.25%.

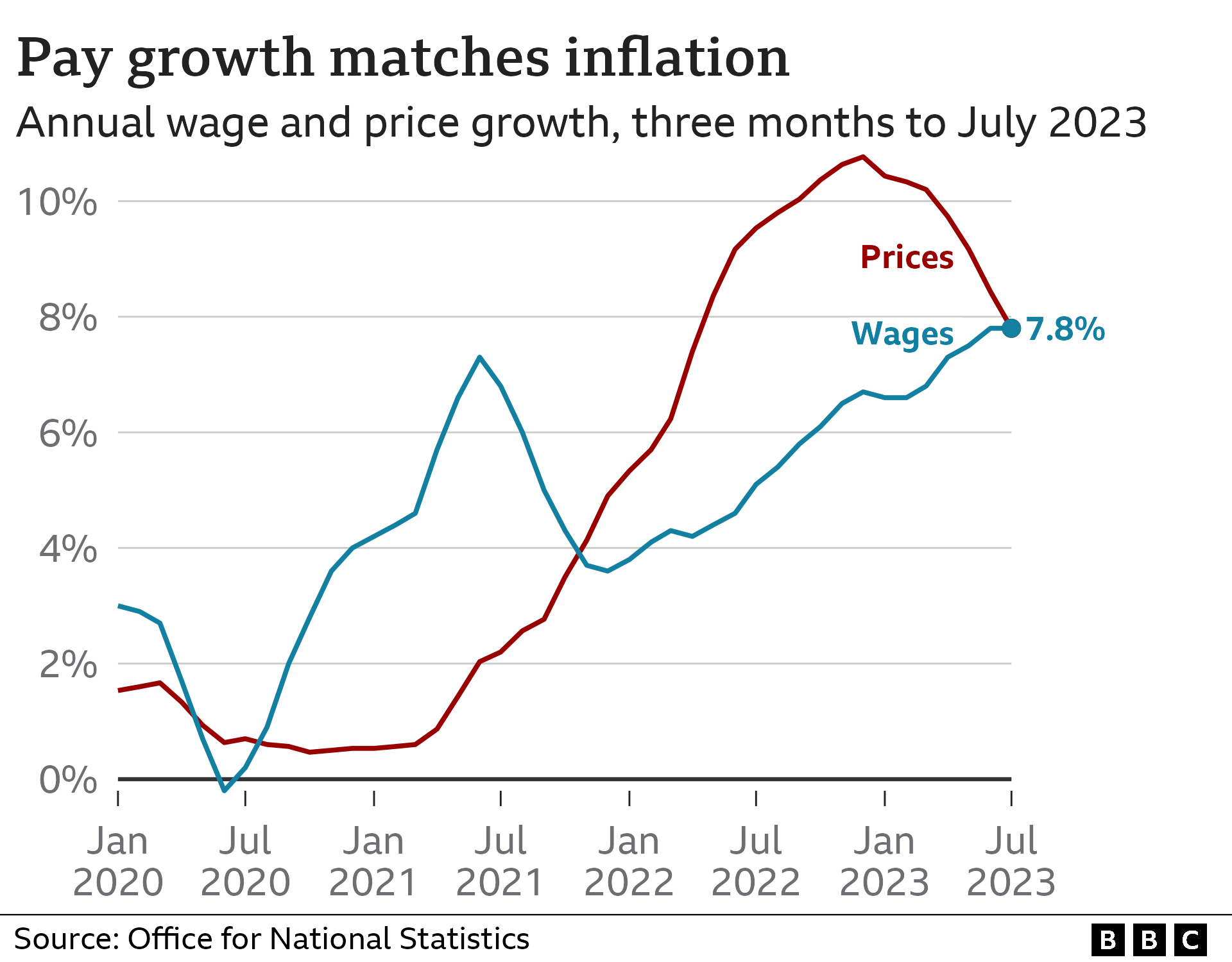

Are wages keeping up with inflation?

Official figures showed that – on average – regular pay excluding bonuses grew by 7.8% between May and July, compared to the same period a year earlier.

This nearly matched the rate of inflation in the same period, which meant real wage growth was almost flat for the first time in two years, after falling behind.

However, unions point out that many workers have received smaller pay increases, and there have been widespread strikes over pay.

The government has argued that big pay rises could push inflation higher because companies might increase prices as a result.

When will inflation go down?

Lower inflation doesn’t mean prices fall. It just means they rise less quickly.

The Bank of England has predicted inflation will drop to 5% by the end of 2023, rather than the 4% it had been anticipating.

Bank governor Andrew Bailey said it was “crucial that we see the job through” and get price rises back to the 2% target, because people “should trust that their hard-earned money maintains its value”.

But he admitted that inflation had been “more sticky than previously expected”.

In October, the International Monetary Fund (IMF) predicted the UK would have the highest inflation rates of any G7 economy in both 2023 and 2024. As a result, it thinks UK interest rates will remain relatively high until 2028.

In January, Prime Minister Rishi Sunak said halving inflation by the end of 2023 was one of the government’s five key pledges.

What’s happening to inflation and interest rates in Europe and the US?

Other countries have also been experiencing a cost-of-living squeeze.

Many of the reasons are the same – increased energy costs, shortages of goods and materials, and the fallout from Covid.

The annual inflation rate for countries which use the euro was estimated to be 4.3% in the 12 months to September, down from 5.2% in August

The European Central Bank had been increasing interest rates to try to bring eurozone inflation under control.

On 14 September, it raised its key interest rate – the benchmark deposit rate – to 4%, a record high, but indicated it might be the last hike for now.

In the US, inflation was 3.7% in the year to August, up from 3.2% in July and 3% in June.

At its September meeting, the US central bank kept its key interest rate unchanged between 5.25%-5.5% as it considers whether it has done enough to stabilise prices.

August had seen the 11th increase since early 2022, with rates at their highest for almost two decades.

It warned further raises would follow “if appropriate”.

Source: BBC