The economy grew marginally by 0.2% in August following a sharp fall in July.

Analysts described the figures as “lacklustre” and said higher borrowing costs and the higher cost of living was weighing on consumers and businesses.

Rates were held at 5.25% in September, ending a run of 14 consecutive rises after inflation started to slow.

Economists said the figures painted a picture of the economy “only just grinding forward”.

“We still haven’t felt the full effect of previous rate hikes, and so the prospects of recession are still looming on the horizon with so little respite expected on sideswiped budgets,” said Susannah Streeter, head of money and markets, Hargreaves Lansdown, adding that the Bank of England looked “set to keep the pause button held on interest rate hikes”.

The UK is not currently in recession but there have been concerns over weak growth, with the economy set to be a key area in the election which is widely expected next year.

In September, Bank of England governor Andrew Bailey said there were “increasing signs” that higher rates were starting to hurt the economy.

Dr Swati Dhingra, a member of the nine-strong Bank of England’s rate-setting committee told the BBC it is “not going to be great times ahead”.

“When you’re growing as slowly as we’re growing now, the chances of recession or not recession are going to be pretty equally balanced,” she told the BBC.

August’s marginal economic growth was driven by the education sector recovering from strike action, as well as a boost from computer programmers and engineers.

In contrast, some sectors fared poorly such as arts, entertainment and recreation. Sports and amusement activities also dropped more than 10% in August.

“Compared with previous months where there’s been a lot of significant factors impacting on the economy both in terms of adding to and reducing growth like the additional bank holiday for the King’s Coronation, large number of working days lost because of industrial action and extreme weather – sunshine and rain – August was relatively quiet in that sense,” Darren Morgan, director of economic statistics at the ONS, told the BBC’s Today programme.

“At the very most, it appears the UK is in a period of stagflation, with the economy stagnating while inflation stays elevated.”

Danni Hewson, head of financial analysis at AJ Bell, said with growth “so slim” a recession was “beginning to feel almost inevitable”, adding with the full extent of higher borrowing costs yet to be felt by consumers, there was a “real sense that economic resilience is fraying”.

Yael Selfin, chief economist at KPMG UK, said the outlook for the UK remained “lacklustre as high interest rates continue to bite”, while Thomas Pugh, economist at consultancy firm RSM UK, said growth “flatlining” pointed towards rates being unchanged in November.

GDP figures show the health of the UK economy. It is a measure – or an attempt to measure – all the activity of companies, governments and individuals in a country.

If the figure is increasing, it means the economy is growing and people are doing more work and getting a little bit richer, on average.

But if GDP is falling, then the economy is shrinking which can be bad news for businesses. If GDP falls for two quarters in a row, it is typically defined as an economic recession.

Next month’s figure showing how the economy has performed over three months will be watched more closely than August’s single monthly figure.

The ONS said overall the economy had grown “modestly” over the past three months thanks to boost from car manufacturing and sales as well as construction.

Chancellor Jeremy Hunt said the latest data showed the economy “is more resilient than expected”.

But shadow chancellor Rachel Reeves said: “Under the Conservatives, Britain’s economy remains trapped in a low growth, high tax cycle that is leaving working people worse off.”

On Wednesday, The International Monetary Fund clashed with UK government after the Treasury claimed its latest assessment of the UK economy was too gloomy.

The influential global group forecasts the UK will have the highest inflation and slowest growth next year of any G7 economy, but the Treasury said recent revisions to UK growth had not been factored in to the IMF’s report.

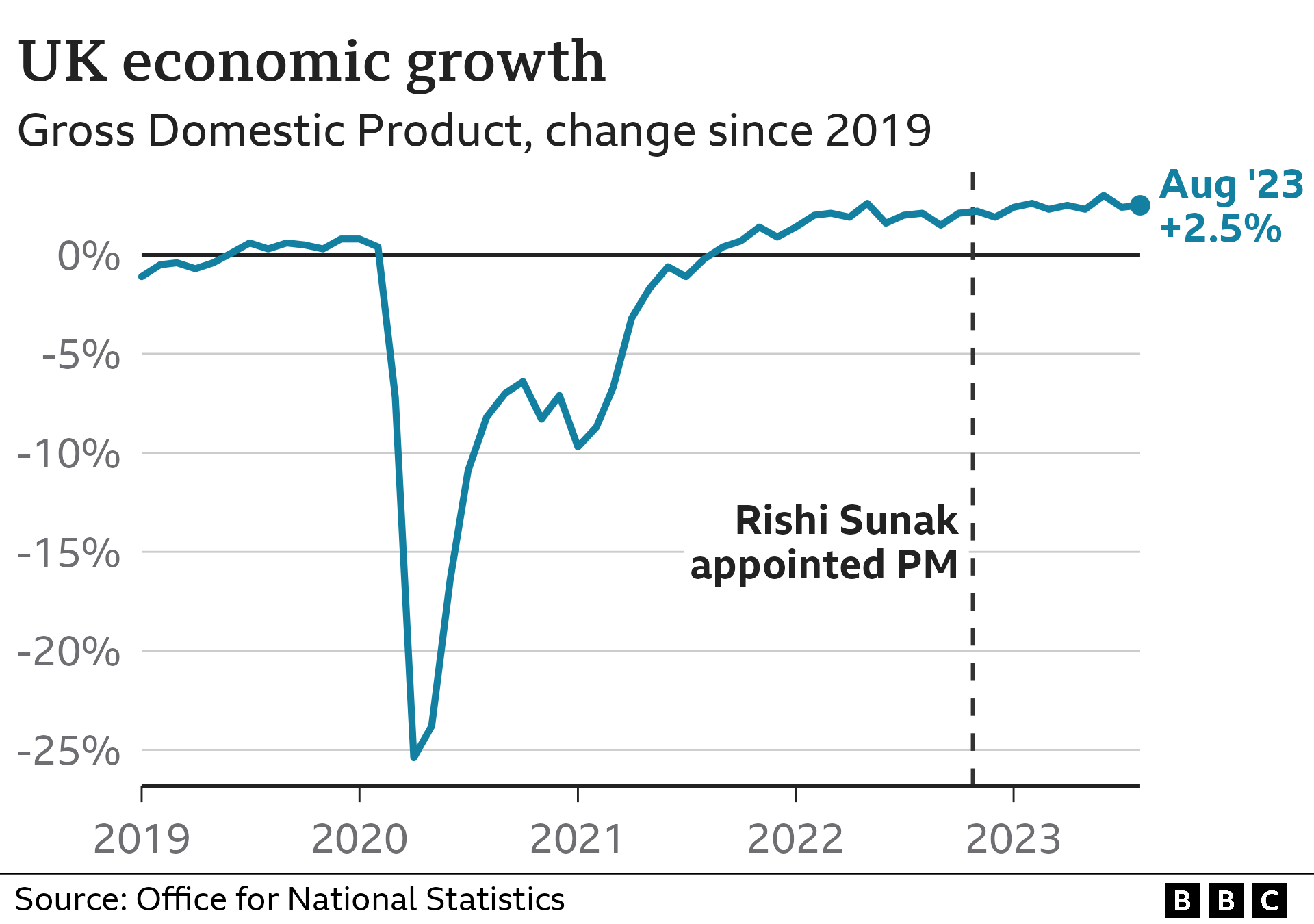

The economy is now 2.1% larger than it was in February 2020, before the Covid pandemic hit.

Source: BBC